What Is The Non Taxable Gift Amount For 2025. Updated per latest interim budget 2025. The gift tax is also applicable on certain transfers that is not considered as a.

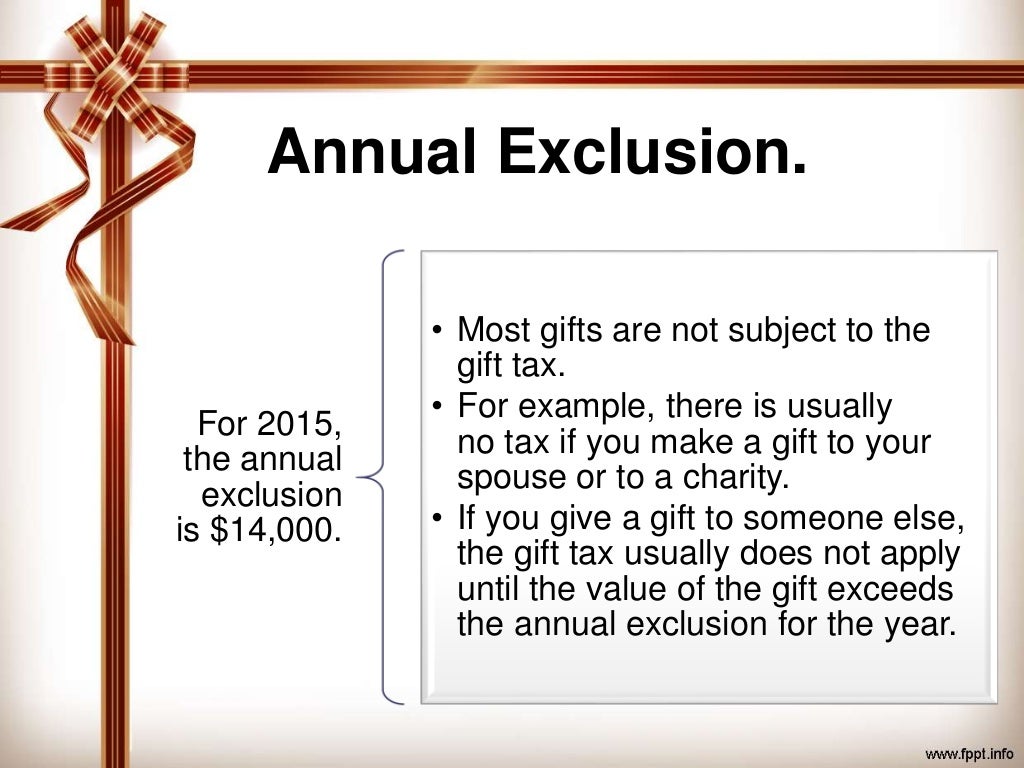

For instance, your favourite book or a. Beginning on january 1, 2025, an individual may make gifts in an amount up to $18,000, in total, on an annual basis to any recipient without making a taxable gift, and married couples who.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Understanding the annual exclusion for gifts. This move is aimed at simplifying the tax filing process and encouraging more individuals to opt for this regime.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For example, a man could give $18,000. The 2025 gift tax limit is $18,000.

Gifting Time to Accelerate Plans? Evercore, For married couples, the limit is $18,000 each, for a total of $36,000. Understanding the annual exclusion for gifts.

annual gift tax exclusion 2025 irs Trina Stack, Movable property, such as drawings, jewellery, share, etc. How are gift and estate taxes figured?

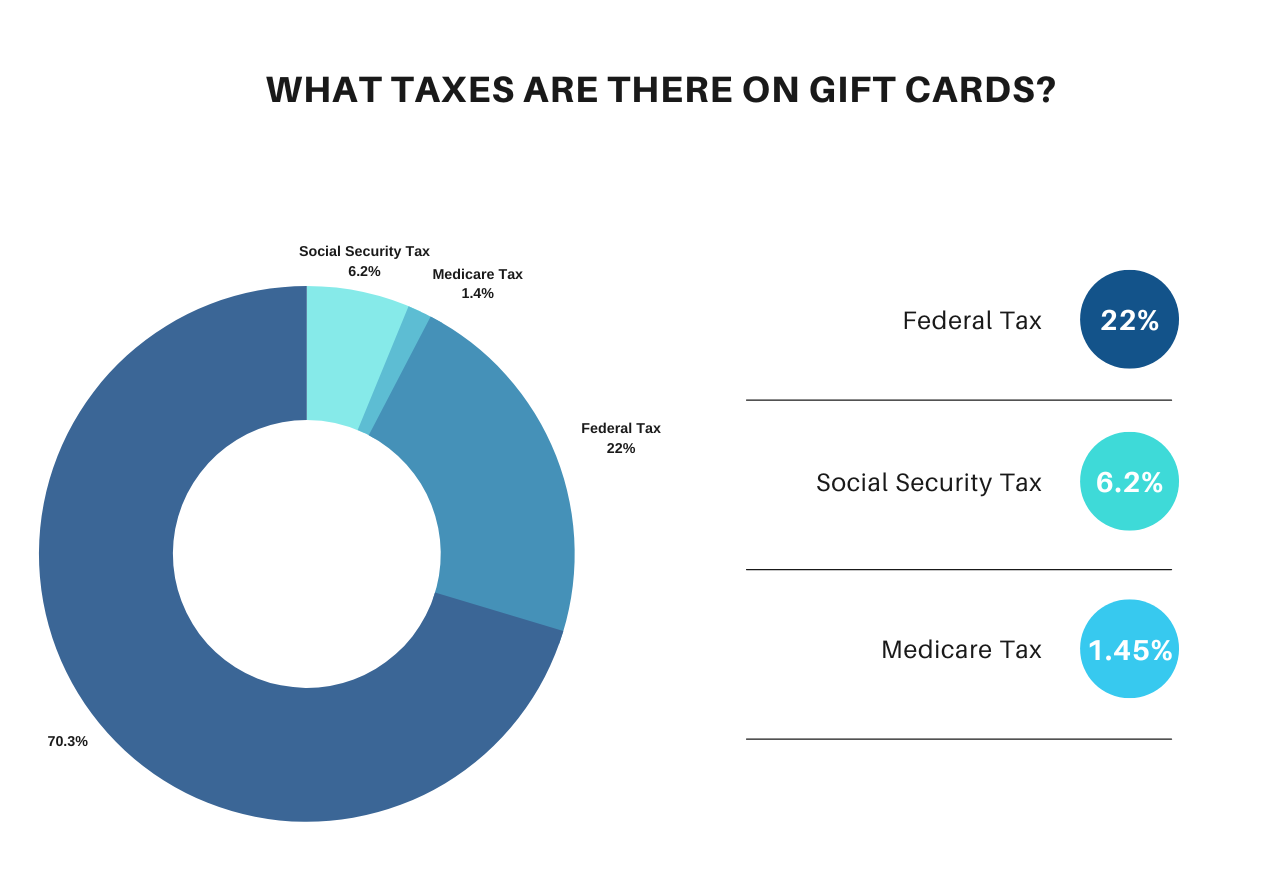

Is There Tax On Gift Cards Are Gift Cards Taxable?, Provisions on taxation on gifts. For example, a man could give $18,000.

Consider Non Taxable Gifts in 2025 Francine D. Ward, Taxed on that amount either.) the gift tax limit for gifts given in 2025 has risen to $18,000. The gift tax limit (or annual gift tax exclusion) for 2025 is $17,000 per recipient.

Annual Gift Tax Limitations Advantage One Tax Consulting, The 2025 gift tax limit is $18,000. If an individual/huf receives from any person or persons any gift, exceeding rs.

Tax tips to help you determine if your gift is taxable, The biden administration continued its effort to extend student debt relief on thursday, erasing an additional $5.8 billion in federal loans for nearly 78,000. This move is aimed at simplifying the tax filing process and encouraging more individuals to opt for this regime.

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, Any gift received from a relative as defined under the income tax act is not taxable in the hands of the recipient, irrespective of the amount received, in other words, there is no. The exclusion will be $18,000 per recipient for 2025—the highest exclusion amount ever.

How To Reduce Taxable A Complete Guide IHSANPEDIA, The annual amount that one may give to a spouse who is not a us citizen will. The exclusion will be $18,000 per recipient for 2025—the highest exclusion amount ever.